If you're already feeling frustrated about the current state of home prices, this will only make matters worse.

Housing costs have reached unprecedented highs, making it exceedingly difficult for first-time buyers to enter the housing market.

Across much of the United States, individuals need a six-figure income to afford a mortgage, with San Francisco topping the list as the city with the most expensive homes.

According to a report by Redfin, San Francisco residents would need an astonishing annual income of $404,332 to become homeowners, given that the median monthly mortgage payment currently stands at $10,108.

On the flip side, the most affordable place to live is Detroit, where an annual income of $51,793 is required to purchase a home.

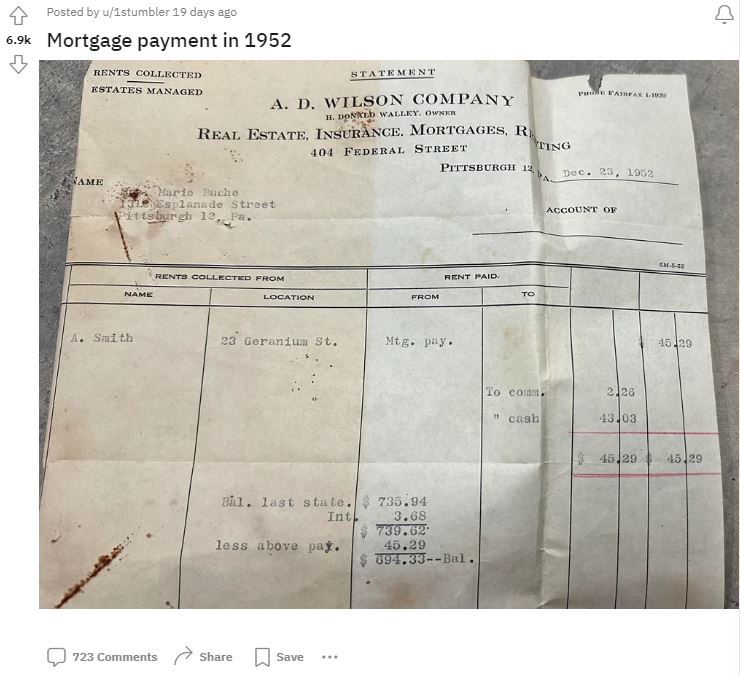

In a Reddit post, an old mortgage payment receipt from 1952 only served to highlight how much more affordable homeownership was in the past.

This viral image revealed that a property owner in Pennsylvania made a monthly mortgage payment of just $45.29.

To put things into perspective, recent research indicates that in many parts of the United States, individuals now need a six-figure income to secure a mortgage.

One person said: 6 more payments to go, 6% interest rate.

Adjusted for inflation, that is $520.79/month now. Of course, the insurance & property taxes aren't added on.

The balance remaining after paying it would be $7,984.17 today.

A second commented: No wonder the population exploded. People could actually afford to live and raise a family.

A third wrote: My mother is 92 and when she talks about her mortgage from the 1960’s, she says, “Boy, that was a long 16 years to pay off the mortgage”.

As per Trading Economics: "Wage Growth in the United States averaged 6.19 percent from 1960 until 2023, reaching an all-time high of 15.28 percent in April of 2021 and a record low of -5.89 percent in April of 2020."

It's rather astonishing to consider that a monthly mortgage payment from 1952 wouldn't even cover the cost of a pair of Nike Dunk sneakers in today's market.