Today, the cost of living is escalating, causing financial strain for many. If you have a higher basic salary, your life could be easier to live. However, many still struggle to live, even with a high salary.

The elderly couple below is proof. In the latest podcast, the US couple admitted they had fallen into 'lifestyle creep' and struggled to make ends meet despite earning $200,000.

The couple revealed they broke and living paycheck-to-paycheck despite earning $200,000.

In the last podcast, the couple confessed to living paycheck to paycheck, despite earning $200,000 and having multiple sources of income.

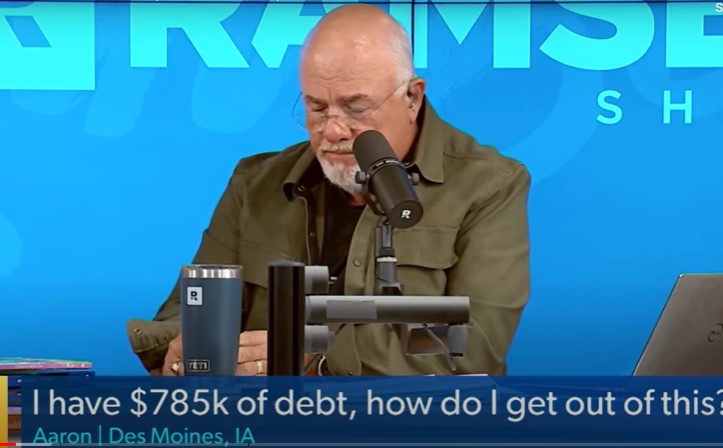

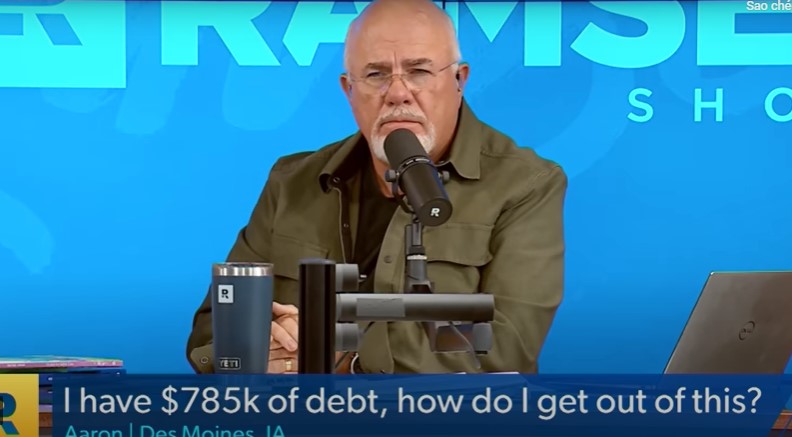

The couple admitted they are feeling the pinch with the cost of living as they are in a whopping $800,000 of debt.

“You guys are seriously broke!' Ramsey declared

“You'll are freaking starving to death making $200,000 and spending like you're in Congress."

“You have a pretty serious level of denial inside your household. I think I am more upset about this than you are."

They admitted to falling into 'lifestyle creep' and living paycheck to paycheck.

Financial advisor Dave Ramsey claimed in the podcast that they are barely making ends meet, even though they earn significantly more than the average American.

Dave Ramsey expressed shock at the couple's financial situation during a podcast discussion.

He identified their problem as 'lifestyle creep', a phenomenon where a person's spending increases faster than their income.

The couple revealed that they are in a staggering $800,000 debt, which explains their paycheck-to-paycheck lifestyle.

Ramsey discovered that the couple earns a base salary of $175,000 and an additional $20,000 from rental properties.

Although they both work, own rental properties that generate additional income, and reside in Des Moines, Iowa, a relatively affordable Midwestern city,. The couple plans to reduce debt while facing struggles to make ends meet.

According to Census data, the median US household income was $74,580 in 2022. So, Dave Ramsey's financial income is not insignificant.

To reduce their debt, the husband, Aaron, is considering selling a rental property worth $325,000. However, his wife is hesitant due to emotional ties and her disbelief in a debt-free lifestyle.

The reason why porposeed the spending spree of couple.

Aaron explained their spending habits, saying, "Less than a year ago my salary doubled, and we just kinda went crazy." The couple has $450,000 in outstanding mortgage debt on their main home, an additional $192,000 on an investment home, and a mix of personal loans, car loans, student loans, and credit card debt.

He emphasized the need for the couple to understand the gravity of their situation and warned against spending money to keep up appearances.

Despite their high earnings, this couple's story highlights the importance of financial management. In these challenging economic times, we hope they find a way to navigate their financial struggles and achieve stability.